Anna Maria Island Florida

Why Choose SDI Appraisal

Stephen D. Ihrig II, SRA is principal of SDI Appraisal, specializing in the valuation of residential real estate. Steve has been providing appraisal and consulting services since 2003.

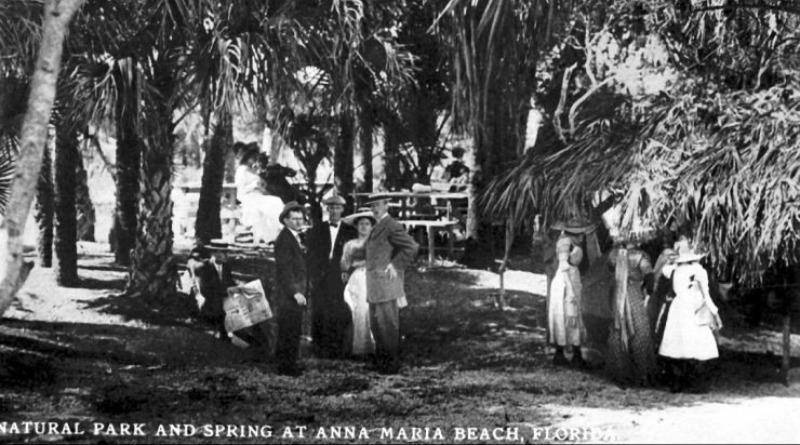

The Rich History of Anna Maria Island Florida

Anna Maria Island, located on Florida’s Gulf Coast, has a captivating history that spans centuries. The island’s first inhabitants were indigenous peoples, including the Calusa and Timucua tribes, who thrived in the region long before the arrival of European explorers. Spanish explorers and settlers eventually made their way to Florida, leaving a cultural imprint on the area. However, it wasn’t until the late 19th century that the island saw significant development.

In the early 1900s, George Emerson Bean, a prominent landowner, recognized the potential of Anna Maria Island and began developing it as a destination for vacationers. Bean’s vision included the construction of the Anna Maria Beach Inn, a popular resort that attracted visitors seeking the island’s pristine beaches and natural beauty. Over the years, the island continued to grow as a vacation destination, with an emphasis on preserving its small-town charm and natural surroundings.

img. source AnnaMariaIsland.com

The Anna Maria Island Historical Society Museum is a must for visitors to the area. Find this great facility in the city of Anna Maria on Pine Avenue.

Anna Maria Island Photo Gallery

Anna Maria Island Florida Property Appraisal

Anna Maria Island’s Real Estate Landscape

Anna Maria Island has weathered storms, economic changes, and shifting tourism trends, but it has remained a beloved destination for those seeking a relaxed and unspoiled coastal experience. Today, the island is known for its beautiful white-sand beaches, historic fishing piers, and charming local businesses. With a commitment to environmental preservation and a dedication to maintaining its unique character, Anna Maria Island stands as a testament to the enduring allure of Florida’s Gulf Coast.

Understanding Home Appraisal for Anna Maria Island

A home appraisal is an unbiased estimate of a property’s fair market value, conducted by a qualified appraiser. Several factors influence this valuation, including the property’s location, size, condition, and comparable sales in the area. The appraisal process involves a detailed examination of the property, considering both its interior and exterior features. Appraisers also analyze recent sales of comparable properties, known as “comps,” to determine the property’s value. Their findings are documented in a comprehensive appraisal report.

Home Appraisal vs. Home Inspection

It’s essential to distinguish between a home appraisal and a home inspection in Anna Maria Island. While an appraisal focuses on determining the property’s value, an inspection evaluates its structural integrity and identifies potential issues. Various myths surround home appraisals, such as the belief that home improvements always result in a higher appraisal. Debunking these myths ensures homeowners have accurate information about the appraisal process.

Choosing the Right Appraiser

Selecting the right appraiser is crucial. Homeowners should prioritize qualified, experienced professionals who remain impartial throughout the appraisal process. Appraisals play a significant role in mortgage approval. Lenders use the appraised value to determine the loan amount they are willing to extend to the borrower.

Realtors and appraisers in Anna Maria Island often work together for their clients. Effective communication between the two parties enhances the overall real estate experience. In cases of disagreement with the appraisal, homeowners have options for resolution. This may involve providing additional information or formally appealing the appraisal.

Reconsideration of Value of Anna Maria Island Homes

Sometimes you disagree with an appraised value, or you just get a bad appraisal. Before getting a second opinion of value (see below) you may be able to resolve your issues by filing a reconsideration of value with the lender. Download our -FREE- “Reconsideration of Value Request” Template and the Example as a guide showing how to fill this form out. Many Realtors have used this more than once, often with great success, so save these on your computer. A well written reconsideration of value is a powerful tool!

Notable Sarasota Florida Property Appraisals

Anna Maria Island Florida Historical Properties

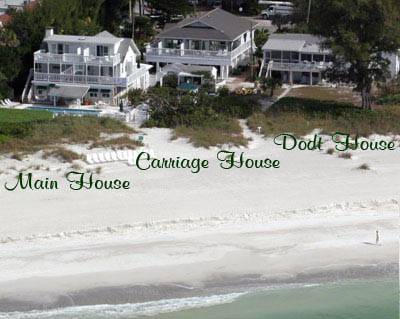

Historic Harrington House Bed and Breakfast

Harrington House has been an institution on Anna Maria Island. For more than 25 years the Harrington House proprietors have been helping visitors find their perfect slice of paradise. While the owners of Harrington House have retired many of their accommodations are available for rent as vacation rentals.

img. source AnnaMariaIsland.com

FAQ Frequently Asked Questions about Property Appraisals

1. What is a property appraisal?

A property appraisal is a professional assessment of the value of a real estate property. It involves a comprehensive evaluation conducted by a qualified appraiser who considers various factors to determine the property’s market value.

- Key Information:

- A property appraisal is conducted by a certified appraiser.

- It provides an unbiased and expert opinion on the property’s value.

- The market value is determined based on factors like location, condition, and recent sales of comparable properties.

2. Why is a property appraisal necessary?

A property appraisal is necessary for several reasons, primarily to determine the fair market value of a property for various stakeholders, such as lenders, buyers, and sellers. It plays a crucial role in real estate transactions.

- Key Information:

- Lenders use appraisals to assess the property’s value for mortgage approval.

- Sellers rely on appraisals to set a reasonable listing price.

- Buyers use appraisals to ensure they are not overpaying for a property.

3. How is the value of a property determined during an appraisal?

The value of a property during an appraisal is determined through a meticulous process that considers multiple factors. Appraisers analyze recent sales data, property condition, location, and other relevant aspects to arrive at an accurate valuation.

- Key Information:

- Recent sales of comparable properties (comps) heavily influence the valuation.

- The property’s physical condition and any improvements or defects are taken into account.

- Location, including neighborhood and proximity to amenities, is a critical factor in valuation.

4. Can property improvements increase its appraised value?

Yes, property improvements can positively impact the appraised value. Appraisers consider any upgrades or renovations that enhance the property’s overall appeal, functionality, and condition.

- Key Information:

- Renovations like kitchen upgrades, additional bathrooms, or modernized systems can increase value.

- Quality materials and craftsmanship in improvements contribute to a higher appraisal.

- It’s essential to keep records of improvements to provide evidence for the appraiser.

5. How long is a property appraisal valid?

The validity of a property appraisal depends on various factors, but typically, it is considered valid for a specific period. The real estate market’s volatility and changes in property values may necessitate more frequent appraisals.

- Key Information:

- An appraisal is typically valid for a few months, often around 90 days.

- Changes in the market, property condition, or significant improvements may prompt the need for a new appraisal.

- Lenders may require a current appraisal at the time of loan approval.

SDI Appraisal Mission Statement

Committed to empowering our clients with clarity and direction.

Stephen D. Ihrig II, SRA is principal of SDI Appraisal, specializing in the valuation of residential real estate. Steve has been providing appraisal and consulting services since 2003. Currently a Certified Residential Appraiser in the State of Florida, Steve was awarded the SRA designation from the Appraisal Institute.

In today’s ever-changing real estate market, utilize only the best and most qualified individuals to perform your residential appraisals. An accurate value supported by data and analysis, that reflects market trends, can hold up in any court of law, is considered a high-quality report by any lender’s underwriting system, and meets all USPAP (Uniform Standards of Professional Appraisal Practice) standards should be your primary objective when retaining a real estate appraiser.

Specialized Professional Education and Development

- SRA Designation, Appraisal Institute

- Private Appraisal Assignments: Attorneys, Accountants, Property Owners, Trusts & other entities

- Expert Witness Testimony

- Real Estate Finance Statistics and Valuation Modeling

- Relocation Appraisal

- REO Appraisal: Appraisal of Residential Property Foreclosure

- FHA & USDA Approved Appraiser

- Uniform Standards of Professional Appraisal Practice (USPAP)

- Michigan State University Alumni

20+ Years of Experience

EXCELLENTTrustindex verifies that the original source of the review is Google. Steve is a wealth of knowledge. We used him for a casualty loss appraisal. He was responsive, professional, and provided a quick turn. We've already recommended him to others. Two thumbs up!Posted onTrustindex verifies that the original source of the review is Google. Absolutely amazing service, response, and professionalism. Quality and turnaround time of the appraisal is unparalleled.Posted onTrustindex verifies that the original source of the review is Google. Steve is an A+ appraiser. We were in a bind and he turned our appraisal around in one day and got us the report the same day. Our bank was also willing to accept it as well. Cannot speak highly enough of him and his service!Posted onTrustindex verifies that the original source of the review is Google. SDI was amazing working with in a very short time frame. Very thorough communication, perfect assessment and very easy to work with, highly recommend if you need an appraisor.Posted onTrustindex verifies that the original source of the review is Google. Can’t say enough great things. This company is more than willing to work the best they can with buyers and sellers schedules! Very fast and very professional! Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. I had a great experience with SDI appraisals! Steve was very personable and he took the time to answer all of my questions. I appreciate how quick he was able to produce a report for me. I’ll be sure to use him again!Posted onTrustindex verifies that the original source of the review is Google. Stephen Ihrig has been honest, diligent, communicative, and detailed in his work for me. He went above and beyond communicating with me about his services while I am in the final stages of my divorce, when the majority of our marital assets are the real estate he appraised for me. I can’t wait to have him be my expert witness for my day in Florida court. Well earned reasonable fee. 100% confidence in SDI and Stephen. I have high standards for quality and I highly recommend!!Posted onTrustindex verifies that the original source of the review is Google. Steve is an awesome appraiser! He is very knowledgeable and goes above and beyond to help with all my appraisal related questions when needed.Posted onTrustindex verifies that the original source of the review is Google. I recently had the pleasure of working with Stephen and SDI Appraisal and I must say I was thoroughly impressed by their professionalism and expertise. From the moment I first made contact, I felt reassured that I was in good hands. Stephen was punctual, respectful, and showed an incredible depth of knowledge about the housing market and appraisal process. He took the time to explain the entire procedure in detail, ensuring we were well-informed and comfortable every step of the way. The appraisal report itself was delivered promptly and was comprehensive, yet easy to understand. It provided valuable insights into my property's value and how it compares to others in my neighborhood. I was also impressed by the inclusion of clear, high-quality photos and detailed explanations for each valuation point. This experience has made me appreciate the value of a skilled, professional appraiser. I highly recommend Stephen and SDI Appraisal to anyone in need of a thorough and accurate home appraisal.Posted onTrustindex verifies that the original source of the review is Google. Steve was extremely informative and professional. He did some background research without charge and recomnended that I seek someone more local based on tge purpose for my appraisal and was kind enough to provide 3 additional referrals. Couldn’t have asked for anything more from a cold call. Thanks again for all your help Steve!